Imagine having a special window into the financial pulse of almost every country on the planet, all from one spot. You can actually see more than twenty million different bits of economic information, covering nearly two hundred nations, which is a pretty vast collection. This means whether you are curious about what is happening in a big economy or a smaller one, the details are available, just waiting for you to check them out.

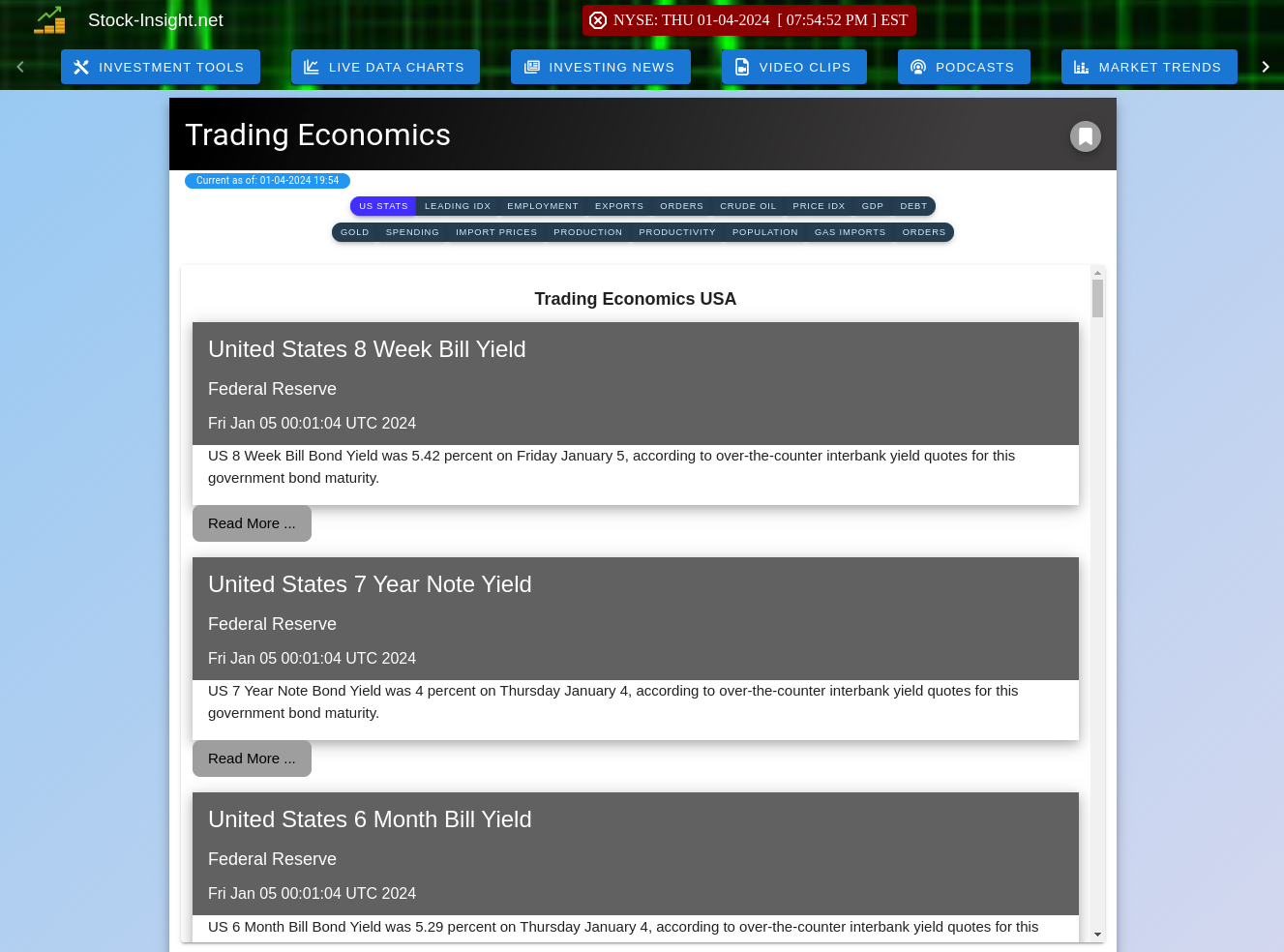

This access lets you grab free pieces of economic data, like historical records that show how things have changed over time. You can also look at visual representations, read up on current happenings, and even see what experts think might happen in the future for those same countries. It's like having a library and a newsstand combined, you know, for economic stuff.

There is also a calendar feature that lays out important events for nearly two hundred countries, too it's almost like a daily planner for the global economy. This includes when new numbers for three hundred thousand economic measures are going to be released, what those numbers actually turned out to be, what people generally expected them to be, and some special guesses about what's coming. It helps keep you in the loop, really.

- Paintball Explosion

- Charleston County Public Library

- Scripps Ranch High School

- Amc Regency 24 Jax Fl

- Virginia Beach Field House

Table of Contents

- What Can Trading Economics Offer You?

- Getting Your Hands on Trading Economics Information

- How Does Trading Economics Keep Its Information Fresh?

- Exploring Different Kinds of Trading Economics Data

- Can Trading Economics Help You Understand Specific Markets?

- Looking Ahead with Trading Economics Forecasts

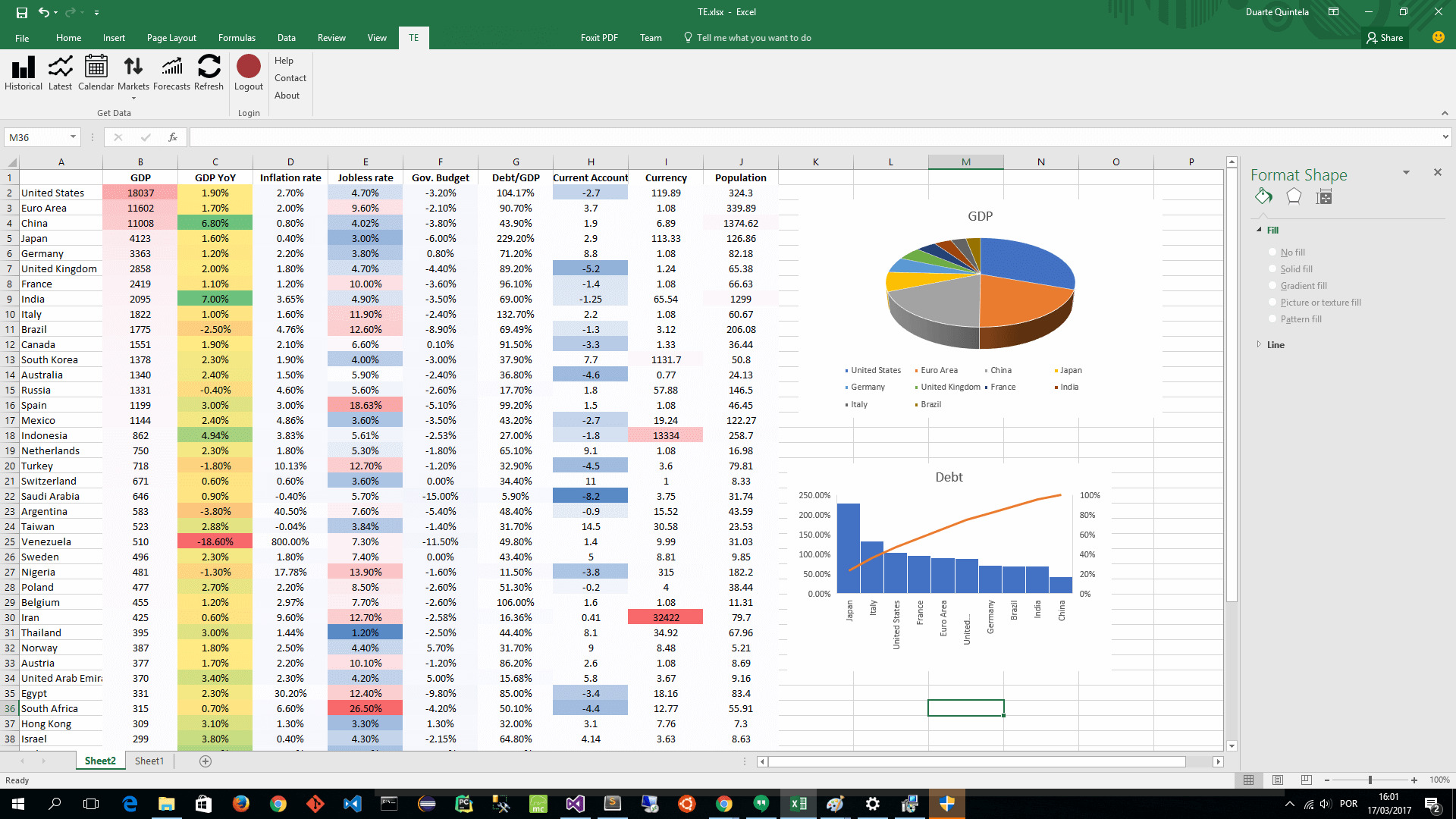

- What Do Real-World Numbers Look Like on Trading Economics?

- A Summary of Trading Economics Information

What Can Trading Economics Offer You?

When you consider what is available, the sheer amount of economic information is quite something. You get to see over twenty million different economic indicators, which are basically little pieces of data that tell you something about how an economy is doing. These bits of information cover a huge number of places, specifically one hundred and ninety-six different countries, so you can get a very wide view of things, you know.

You can get these indicators for free, which is a pretty good deal. This means you don't have to pay to see important economic facts. Along with the current numbers, you also get to look at historical data, which shows you how these figures have changed over time. It's like seeing a timeline of economic activity, which can be really helpful for spotting patterns, actually.

Beyond just numbers, the platform gives you charts. These visual tools make it much easier to see trends and compare different data points without getting lost in rows of figures. There is also news, so you can read about what is happening in the world that might affect these economic measures. And, you know, there are forecasts too, giving you an idea of what experts think might happen next for these countries.

- Kona Kitchen Seattle

- Kempinski Hotel Cancun

- Dockweiler State Beach

- Icelandic Phallological Museum

- Crystal Art Museum

Getting Your Hands on Trading Economics Information

Accessing the data on trading economics is set up to be pretty straightforward. It is a way to look at and even download a great many indicators, thousands of them, for nearly two hundred countries. This includes all sorts of economic indicators, like how much a country is producing or how many people have jobs. You can also find information about stock market indexes, which show how well a country's stock market is performing, you see.

Then there are exchange rates, which tell you how much one country's money is worth compared to another's. You can also find details on commodities, like oil or gold, and information about bonds, which are a kind of loan to governments or companies. So, it is a very wide collection of financial data, all in one spot, which is quite useful, honestly.

The calendar feature is a helpful tool for keeping up with scheduled economic events. It lists data releases for a massive number of economic indicators, around three hundred thousand of them, across those one hundred and ninety-six countries. For each event, you can see the actual numbers that came out, what people generally expected those numbers to be, and some special predictions about what might happen. It is a bit like having a heads-up on important announcements.

How Does Trading Economics Keep Its Information Fresh?

Keeping information current is a big part of what makes a data source useful, and with trading economics, the database gets updated all the time. This means that when new economic figures or market prices come out, they are added to the system pretty quickly. It is important because financial markets and economic conditions can change fast, so having the latest numbers is crucial for anyone looking at this kind of information, you know.

Beyond just adding new information, the data is also regularly checked for any problems or inconsistencies. This checking process is done by comparing the information against official sources. These official sources include central banks, which are the main financial institutions in a country, and national statistics bureaus, which are the places that collect and publish a country's official numbers. They also check against the World Bank, which is a big international organization that provides financial help and advice to countries, so that helps ensure accuracy, apparently.

This careful checking helps to make sure that the numbers you are looking at are dependable and accurate. It is like having a quality control system for the economic information. This gives people who use the platform a good feeling that the data they are seeing is reliable, which is very important when you are trying to make sense of financial trends or economic conditions, as a matter of fact.

Exploring Different Kinds of Trading Economics Data

When you look at what is available on trading economics, you find a lot of different categories to explore. You can look at the calendar, which we talked about, to see upcoming events. There is also a news section, where you can read about current happenings that might affect markets and economies around the world. It is a good way to stay informed about what is going on, you see.

You can also look at markets, which covers things like stock markets and other financial places where things are bought and sold. There are sections for commodities, which are raw materials like oil, gold, or agricultural products. Currencies are also covered, letting you see how different countries' money is performing against each other. And there is even information about crypto, which refers to digital money like Bitcoin, so that is pretty comprehensive, really.

Bonds are also included, which are essentially promises to pay back money with interest, usually issued by governments or large companies. So, you can find a lot of different types of financial information, all in one place. It is set up so you can explore data by country, by the specific indicator you are interested in, by the calendar, by forecasts, by ratings, and even by different solutions or tools available, which is quite handy, anyway.

Can Trading Economics Help You Understand Specific Markets?

For those interested in specific market areas, trading economics offers detailed information on several commodities. This means you can get very particular data for things like oil, natural gas, precious metals, or agricultural products. It is not just general information; it is quite specific, actually.

For these commodities, you can see live bid and ask quotes. The bid quote is the highest price a buyer is willing to pay, and the ask quote is the lowest price a seller is willing to accept. These are live, meaning they are updated as soon as they change, which is very useful for people watching these markets. You also get to see the last trading prices, which tells you what the commodity was last bought or sold for, you know.

The platform also provides forecasts for these commodities, giving you an idea of what experts predict for their future prices. There are charts with historical time series, which let you see how commodity prices have moved over long periods. This can help you spot trends or understand past price changes. And, of course, there is news related to commodities, so you can read about events that might be affecting their supply or demand, which is pretty helpful, so.

Looking Ahead with Trading Economics Forecasts

One of the really helpful things about trading economics is its focus on what might happen next. It provides forecasts for a huge number of financial markets, around thirty thousand of them. This means you can get predictions for various parts of the financial world, not just a select few. It is a wide range of market predictions, which is quite something.

Beyond markets, it also offers forecasts for more than four thousand key economic indicators. These are the important numbers that give us a sense of how economies are performing, like inflation rates or unemployment figures. Having predictions for so many of these indicators gives a broad view of future economic possibilities, which is useful for anyone trying to plan ahead, you see.

These forecasts generally look ahead for the next four quarters, which is a year, or for the next three years. This gives you both a shorter-term outlook and a bit of a longer-term perspective on where things might be headed. It is like having a peek into what the economic future might hold, based on expert analysis, which can be very insightful, honestly.

What Do Real-World Numbers Look Like on Trading Economics?

To give you a clearer picture, let's look at some actual numbers that you might find on trading economics. For instance, the inflation rate in the United States went up to 2.40 percent in May from 2.30 percent in April of 2025. This shows a slight increase in how fast prices were going up, which is a common economic measure that people keep an eye on, you know.

Another example is the yield on the US 10-year note bond. This number went up to 4.35% on July 3, 2025. This was a small increase of 0.07 percentage points from the day before. Bond yields are important because they can tell you about interest rates and investor confidence, so that is a figure many people watch, actually.

Then there is the main stock market index for the United States, often called the US500. This index went up to 6279 points on July 4, 2025, which was a gain of 0.83% from the previous trading day. Over the past month, this index had climbed 5.73%, and it was up 12.79% compared to the same time last year. These figures come from trading on a contract for difference, or CFD, which tracks this important benchmark index from the United States. It gives you a sense of how stock markets are moving, really.

A Summary of Trading Economics Information

Trading economics provides a vast collection of economic information, with more than twenty million indicators covering nearly two hundred countries. It offers free access to current data, historical records, charts, news, and future predictions. A calendar feature lists data releases for hundreds of thousands of indicators, showing actual results, expected figures, and special forecasts. The platform also gives specific details for various commodities, including live prices, past trading values, forecasts, historical charts, and related news. It is a way to look at and download a huge number of indicators for almost two hundred countries, including economic measures, stock market performance, currency values, commodities, and bonds. The information is regularly checked against official sources like central banks and national statistics offices to keep it accurate. You can explore different sections such as the calendar, news, various markets, commodities, currencies, cryptocurrencies, and bonds. The platform also offers forecasts for tens of thousands of financial markets and thousands of important economic indicators, looking ahead for the next few quarters or years. It includes examples of real-world data like inflation rates, bond yields, and stock market index movements.

Related Resources:

Detail Author:

- Name : Avis Kshlerin

- Username : adenesik

- Email : marta.cole@ortiz.biz

- Birthdate : 1991-03-28

- Address : 610 Johnson Meadow Apt. 898 Medhurstchester, IL 66011-7369

- Phone : 386.858.7766

- Company : White, Morissette and Ritchie

- Job : Able Seamen

- Bio : Veniam cumque enim doloribus dolore. Harum ut doloremque distinctio ipsa quam impedit illum. Autem aut ut fuga voluptatem. Incidunt nam qui ipsam qui tempore esse.

Socials

facebook:

- url : https://facebook.com/alecschmitt

- username : alecschmitt

- bio : Sit beatae fuga quod impedit velit. Ex et aliquam enim est.

- followers : 3981

- following : 1533

instagram:

- url : https://instagram.com/aschmitt

- username : aschmitt

- bio : Voluptas iure unde sit. Autem saepe nisi et placeat enim velit.

- followers : 5865

- following : 1550

tiktok:

- url : https://tiktok.com/@alec_schmitt

- username : alec_schmitt

- bio : Voluptatem unde et repellendus odit temporibus aspernatur.

- followers : 2251

- following : 589

linkedin:

- url : https://linkedin.com/in/alec5393

- username : alec5393

- bio : Occaecati nisi a amet quasi odit amet.

- followers : 5321

- following : 1111