Figuring out what's what with your property taxes in Gwinnett County can, you know, feel like a lot to take in at first glance. For homeowners and anyone thinking about owning a place here, getting a good grasp on how these taxes work is, actually, pretty important. It's all about making sure you understand your responsibilities and, just as important, what resources are available to help you along the way. We're going to talk about the different parts of paying your taxes, seeing your bills, and even applying for ways to pay a little less.

This article aims to, like, lay out the basics for you, covering everything from how you can look up your property's information to what happens if a payment slips past its due date. We'll also touch on how the money from your Gwinnett County property tax contributions helps keep local services going, which is, obviously, a big part of living in a community. You'll find out about the people who help with assessments and collections, and where to go if you have questions or need to appeal something.

Our goal here is to make this whole topic a little less confusing and a lot more approachable. So, whether you're a long-time resident or someone new to the area, we hope this information helps you feel more comfortable with your Gwinnett County property tax obligations. It's, in a way, about making things clear and simple, so you can manage your home finances with a bit more ease.

- Graduation Alliance

- Volare Chicago

- St Peters University Hospital

- Southern New Hampshire Medical Center

- Botanica The Wichita Gardens

Table of Contents

- What You Need to Know About Gwinnett County Property Tax Payments?

- Are There Ways to Lessen Your Gwinnett County Property Tax Burden?

- What Happens if Gwinnett County Property Tax Payments are Late?

- How Gwinnett County Property Tax Helps the Community

What You Need to Know About Gwinnett County Property Tax Payments?

When it comes to your Gwinnett County property tax, there are a few key things you'll want to get familiar with. This includes how you go about making your payments, how you can actually see your tax bills, and even how you might be able to apply for certain exemptions that could save you some money. It's all about having the right information at your fingertips, so you can handle these important financial pieces without too much fuss, you know?

You can also, actually, get information about properties that have been sold for taxes, what are sometimes called tax liens, and what your financial responsibilities might be for a new place you just bought or a property that was recently sold. Knowing these aspects of Gwinnett County property tax can, in some respects, help you stay ahead of things, especially if you're involved in buying or selling real estate. It's, basically, about being informed so you can make good decisions.

The Gwinnett County tax assessor's office is, like, a really important place for all this. They're the ones who give your property a value, do the appraisals, keep the records, and offer services to people who pay taxes, making sure your property's worth is figured out correctly and that any exemptions you qualify for are put into place. They're pretty much the source for a lot of the core Gwinnett County property tax details.

- Mercato Naples

- Lighthouse Place Premium Outlets

- Hilton London Kensington

- Hasbro Childrens Hospital

- Clifton Amc Movie

If you're looking to find out more about a property or recent sales in your area, there are simple steps to follow. You can, for example, put in a specific parcel number, like "R8001 001" or "r8001 a 001," or you could use the name of the person who owns the property, or even just the street address, into a search box. This helps you get a better picture of the Gwinnett County property tax situation for a particular spot.

There are also some quick ways to get to related services that might be helpful. These include things like information about jobs and careers, the main GwinnettCounty.com website, how to appeal your property's value, getting driver's licenses and ID cards, details from the Georgia Department of Revenue, records about deeds and land, business licenses, and even where to go for recycling and solid waste services. Plus, you can find them on social media, too it's almost like a one-stop shop for Gwinnett County property tax and other public needs.

Getting a Handle on Your Gwinnett County Property Tax Bills

The tax commissioner is, essentially, the person in charge of sending out your Gwinnett County property tax bills, gathering the money, and then making sure those funds go to the right places, like the various government bodies that need them. This role is, obviously, a big deal because it ensures the system runs smoothly and that the money gets where it needs to be to help the community.

You can, you know, easily look at your current or even past Gwinnett County property tax bills online. It's a pretty straightforward process. To find your specific bill, you can search using the property owner's name, the parcel number, the mailing address for the property, or even just its physical location. This flexibility makes it, like, really convenient to access your information whenever you need it.

It's also possible to learn about the rules for Gwinnett County property tax, different ways to get exemptions, how to file your tax returns, what to do if you want to appeal something, and how to make your payments. You can find out about the local tax officials, when things are due, what forms you might need, and resources for specific types of exemptions, like homestead, freeport, mobile home, and intangible taxes. All these details are, in fact, available to help you stay informed.

Denise Mitchell, the Gwinnett County tax commissioner, is a constitutional officer, which means she's elected by the people to do a very important job. She's responsible for, basically, sending out bills, collecting, and giving out personal and property taxes, and she also manages the homestead exemptions. Furthermore, she acts as a representative for the state of Georgia, handling the registration and titling of motor vehicles and making sure the money from those activities is given out properly. She's, you know, a very busy person with a lot on her plate when it comes to Gwinnett County property tax and other related services.

For property owners who apply for a county homestead exemption, if they live in a city that gets its bills from the tax commissioner’s office, they will, actually, automatically receive any city exemptions they might be able to get. This makes the process, in some respects, simpler for many residents. However, if you need specific information about taxes in Gwinnett cities that are not billed by the county, it’s best to get in touch with that city’s own tax department directly. They’ll have the precise Gwinnett County property tax details for their area.

There are also some handy hints available for tags and taxes, which can be, you know, quite helpful for vehicle owners. The Gwinnett County tax assessors' office provides ownership data for properties, which includes specific details about who owns what and the assessed values for each piece of land. This information is, basically, there to give you a clear picture of property ownership and its worth for Gwinnett County property tax purposes.

Are There Ways to Lessen Your Gwinnett County Property Tax Burden?

When thinking about your Gwinnett County property tax, many people wonder if there are ways to make the amount they pay a little less. The good news is, yes, there are programs and exemptions that can, in fact, help reduce your tax bill if you meet certain criteria. These are designed to provide some relief to homeowners, especially those who qualify for specific situations like age, disability, or simply making their home their primary residence. It's worth looking into these possibilities, honestly, to see if you can save some money.

One of the most common ways to potentially lessen your Gwinnett County property tax is through the homestead exemption. This is for people who own and live in their home as their main place of residence. Applying for this can, you know, lower the taxable value of your property, which then results in a smaller tax bill. There are other exemptions too, like those for certain types of businesses (freeport) or for mobile homes, and even for intangible property. Each has its own set of rules, but they are all there to potentially help reduce your overall Gwinnett County property tax amount.

It’s important to, like, understand that these exemptions don't just happen automatically unless you've already applied for a county homestead exemption and live in a city billed by the tax commissioner. For most others, you need to actively apply for them. This means filling out the right forms and providing any necessary documents to prove you meet the requirements. It’s a process, but for many, the savings on their Gwinnett County property tax can be quite significant, making it totally worth the effort.

Who Helps with Gwinnett County Property Tax Information?

When you have questions about your Gwinnett County property tax, there are a couple of main offices that can help you out. First, there's the Gwinnett County tax assessor's office. Their job is, essentially, to put a value on your property. They handle the assessments and appraisals, making sure that every piece of property in the county is valued fairly and equally according to Georgia's tax rules. They also keep all the records related to property ownership and value, which is, you know, pretty important for transparency.

Then, there's the Gwinnett County tax commissioner's office. This office is responsible for, basically, sending out the bills, collecting the money, and then making sure that the Gwinnett County property tax funds are sent to all the right places – like the county government, schools, and cities. If you have questions about your bill, making a payment, or applying for a homestead exemption, the tax commissioner's office is, in fact, the place to go. They also, by the way, handle vehicle registrations and titles for the state.

Both of these offices have resources available to the public. You can, for instance, find forms, due dates, and information about various tax laws and exemptions. They are there to help you understand your Gwinnett County property tax obligations and make sure you have access to the information you need. So, if you're ever feeling a bit lost, these are the folks to reach out to for assistance.

What Happens if Gwinnett County Property Tax Payments are Late?

It's a good idea to know what happens if your Gwinnett County property tax payment isn't made on time. Property tax bills are, typically, sent out in August, and for example, the 2024 bills were due by October 15th. If, for some reason, your payment is late, there will be extra charges added to the amount you owe. This includes both interest and a penalty, which can, you know, add up over time.

The first time these extra charges are added is on the very first day your balance is considered past due. After that, more charges are added on the second day of each month that the payment remains unpaid. So, it's, basically, in your best interest to make sure your Gwinnett County property tax payment is submitted before the due date to avoid these additional fees. It can save you quite a bit of money, honestly, in the long run.

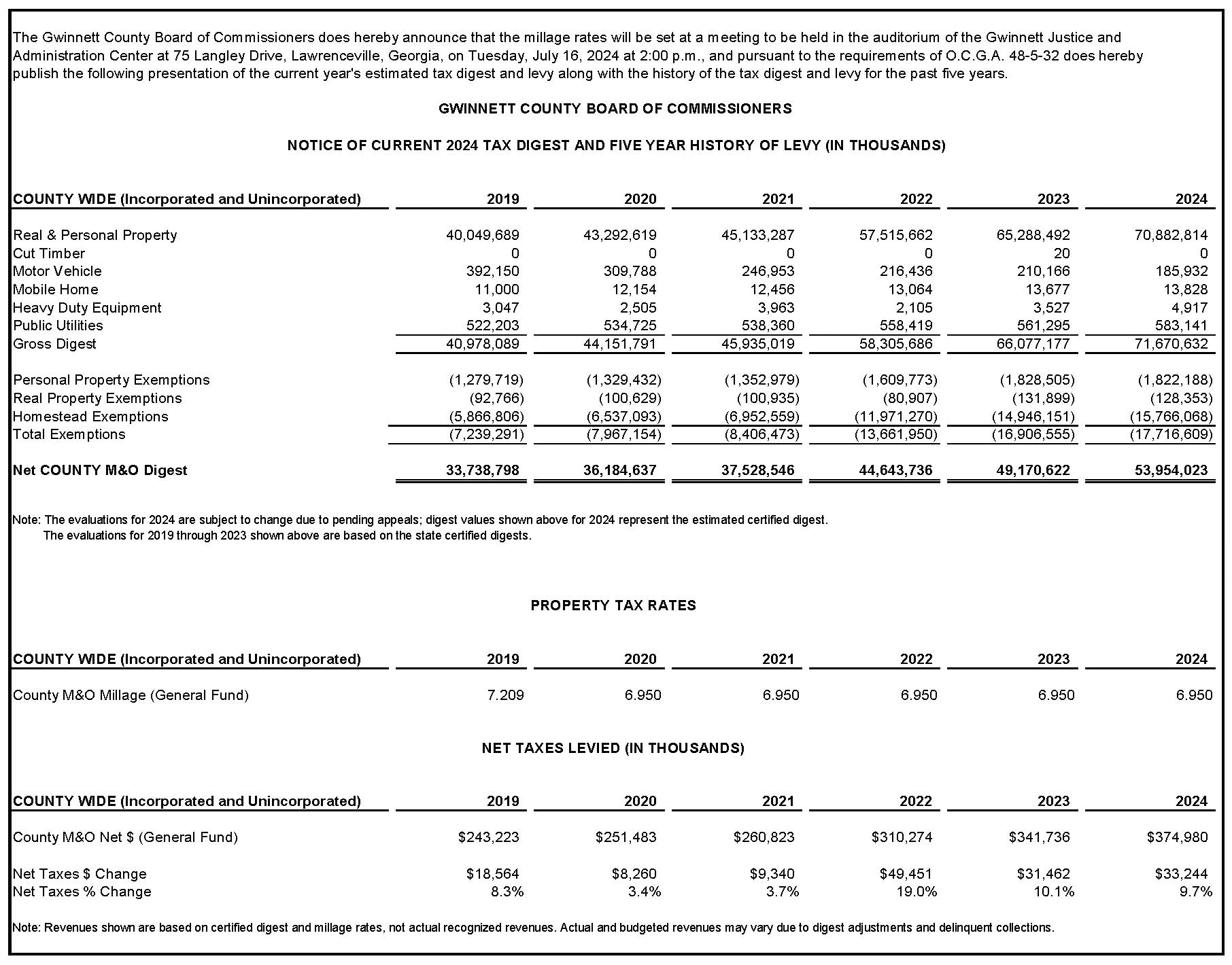

On a slightly different note, a recent vote means that Gwinnett homeowners’ property value assessments will, apparently, stay the same, no matter what happens with inflation. This was stated by officials after three public meetings were held at the Gwinnett Justice and Administration Center in January and February. This decision, in a way, provides some stability for Gwinnett County property tax assessments, which is, you know, a pretty big deal for homeowners.

Where Can You Find More Gwinnett County Property Tax Details?

If you're looking for more specific information about your Gwinnett County property tax, there are tools and resources available. For example, there's a feature that lets you see the value you get in public services for the property taxes you pay to the Gwinnett County government. This tool is, like, meant for educational purposes, helping you understand where your money goes. You can get started by clicking on one of the options provided on their website, which is, honestly, pretty cool.

It’s also helpful to know about the different groups that collect Gwinnett County property tax. This includes the county itself, the school systems, and sometimes, even the cities. It's worth noting that not all cities actually collect property tax. Each of these groups, you know, levies a tax, which means they set their own rate to collect funds for their specific needs.

You might also hear about something called a "rollback rate." This is the tax rate that, when applied to the current year's property values, brings in the same amount of tax money as was collected from the previous year's property values. It's a way to, basically, adjust the rate so that the overall revenue stays consistent, even if property values have changed. It's a rather technical term, but it's part of how Gwinnett County property tax rates are sometimes calculated.

If you're curious about the property sales in your neighborhood that helped determine your property's value, you can, in fact, get that information. You just need to visit the property information search webpage. All the details about neighborhood properties and sales are, like, available online. When you're searching, just make sure to put in the parcel number, the property owner's name, or the property address to find what you're looking for. This helps you understand how your Gwinnett County property tax assessment was reached.

How Gwinnett County Property Tax Helps the Community

The money collected from Gwinnett County property tax is, honestly, pretty important for keeping our community running smoothly. These tax revenues, which come from people who own property, help pay for a wide range of government services. This includes things like our parks, the police and fire departments that keep us safe, utilities, and many, many other essential services that we all rely on every day. So, your Gwinnett County property tax payments are, basically, directly contributing to the quality of life here.

Gwinnett County has, you know, received consistent recognition from national groups for how responsibly it manages its money and how efficiently it operates. This means that the county is, like, pretty good at using the Gwinnett County property tax money it collects wisely and effectively. It's a sign that the funds are being put to good use for the benefit of everyone who lives here.

The Gwinnett County Board of Assessors has a very clear mission. Their goal is to, essentially, apply the Georgia tax code fairly and equally to make sure they produce an acceptable annual property tax list on time. Their vision is to use the best methods in the industry to ensure that every property in the county is valued fairly and equally. Their responsibilities include finding and valuing all taxable property in Gwinnett County, which is, you know, a huge job but a really important one for the Gwinnett County property tax system.

This commitment to fairness and accurate valuations means that when you pay your Gwinnett County property tax, you can have confidence that your contribution is based on a thoughtful and equitable assessment. It's all part of making sure the system works well for everyone, helping to fund the services that make Gwinnett County a good place to live and work. So, in a way, your taxes are an investment in the place you call home.

This article has covered how to pay and view your Gwinnett County property tax bills, how to apply for exemptions, and where to find information on tax sales and property details. We've also talked about the roles of the tax assessor and commissioner, what happens with late payments, and how your tax dollars support various community services.

Related Resources:

Detail Author:

- Name : Audreanne Kuhn

- Username : floyd89

- Email : hillard79@littel.com

- Birthdate : 1992-02-18

- Address : 222 Hirthe Burgs North Sheilaland, OR 23070

- Phone : 620-460-4926

- Company : Rutherford, Thompson and Nitzsche

- Job : Job Printer

- Bio : Expedita sed nihil dolor eos nihil ut. Minus laboriosam debitis alias modi sit quis. Aut rerum dolores quae quidem consequatur. Voluptas autem doloremque ea nihil.

Socials

tiktok:

- url : https://tiktok.com/@cstroman

- username : cstroman

- bio : Quia aut reiciendis omnis voluptatem eius officiis.

- followers : 3039

- following : 679

linkedin:

- url : https://linkedin.com/in/cstroman

- username : cstroman

- bio : Aut minima fugiat autem ad soluta qui.

- followers : 1851

- following : 1351

facebook:

- url : https://facebook.com/clairstroman

- username : clairstroman

- bio : Et quisquam quidem eligendi velit eum exercitationem.

- followers : 3329

- following : 501

twitter:

- url : https://twitter.com/stromanc

- username : stromanc

- bio : At eius et aut magnam quo. Sed consequatur qui sapiente. Et illo quis iure. Dignissimos perspiciatis ut qui magni deleniti quae.

- followers : 5393

- following : 2231