Sometimes, life throws unexpected things your way, and you might find yourself needing a little extra cash, pretty quickly, you know? It happens to everyone, and finding a simple, straightforward way to get some financial breathing room can feel like a big deal. That's where a service like Advance 24/7 comes into the picture, offering a helping hand when you're looking for funds without a lot of fuss or complicated steps. They've been around for a while, actually, helping people get access to money when they need it, whether it's for something planned or something that just popped up.

Think about those moments when a bill arrives sooner than you thought, or perhaps a small home repair just can't wait, so. Having options that are open at all hours can make a real difference. This particular service focuses on making the process of getting money a lot less stressful, letting you apply from home and get answers without a long wait. They understand that when you need funds, you often need them right away, and they've shaped their offerings around that very idea.

So, if you're curious about how a financial service can truly be there for you, around the clock, and offer different kinds of money solutions, then you're in the right spot. We'll take a look at what makes Advance 24/7 a choice for many people across several states, what kinds of money arrangements they have available, and what you might want to think about before moving forward, basically. It's all about getting you the information you need to make a good choice for your personal situation.

Table of Contents

- What Can Advance 24/7 Do for You?

- Where Does Advance 24/7 Lend a Hand?

- How Does Advance 24/7 Make Things Simple?

- Need to Connect? Advance 24/7 Is Here

What Can Advance 24/7 Do for You?

When you're looking for a bit of financial support, perhaps to cover an unexpected cost or just to bridge a gap until your next paycheck, Advance 24/7 offers some options, you know. They provide online loans that can go up to $4,000, which is a pretty good amount for many everyday needs. This service is available in quite a few places, specifically in 21 different states, including places like Tennessee, South Carolina, and Wisconsin. So, if you live in one of these areas, it's something you might want to look into when you're considering your choices for getting some quick money, actually.

The whole idea behind what they do is to give people a straightforward way to get money without too much hassle. They understand that when you're in a spot where you need funds, you don't want to deal with a lot of paperwork or long waiting periods. That's why they focus on making their process as quick and as simple as they can, so you can move on with your day. It’s about providing a service that fits into your life, not making your life more complicated, in a way.

Getting Started with Advance 24/7

Getting your application in with Advance 24/7 is designed to be a really quick process, you know. You can usually fill out the necessary details in just a few moments. Once you've sent your information over, they work to give you an answer and, if approved, get your money to you very quickly, often on the very same day. This means less waiting around and more getting on with what you need to do, which is pretty helpful when time is a factor, so.

- Perrys Steakhouse Dallas

- Casino 66 New Mexico

- Hasbro Childrens Hospital

- Heywood Hospital

- Amc Regency 24 Jax Fl

A big part of what makes Advance 24/7 appealing is how they let you check things out before you commit. You can use their free application to see what kind of loan offer you might receive. The good thing is that looking at this offer won't have any effect on your credit score, which is a common worry for many people, basically. This gives you a chance to understand your options without any pressure, allowing you to make a choice that feels right for you, at the end of the day.

Where Does Advance 24/7 Lend a Hand?

Advance Financial, which is the company behind the Advance 24/7 service, started back in 1996, so they've been around for a while. Over the years, they've grown quite a bit, reaching nearly 100 physical locations. This growth, you know, shows that they've been able to connect with many people looking for financial help. They're also known for how they treat their customers and how happy their employees are, which often says a lot about a company, actually.

Their services are available in a good number of states, as mentioned before, covering a wide area for folks who might need their help. Whether you're in Tennessee, Missouri, Kansas, or Idaho, or one of the other states they serve, you can look into getting a line of credit or an installment loan online. They aim to be there for people in various parts of the country, making their money solutions accessible to a broad group of individuals, pretty much.

What Kinds of Money Help Does Advance 24/7 Offer?

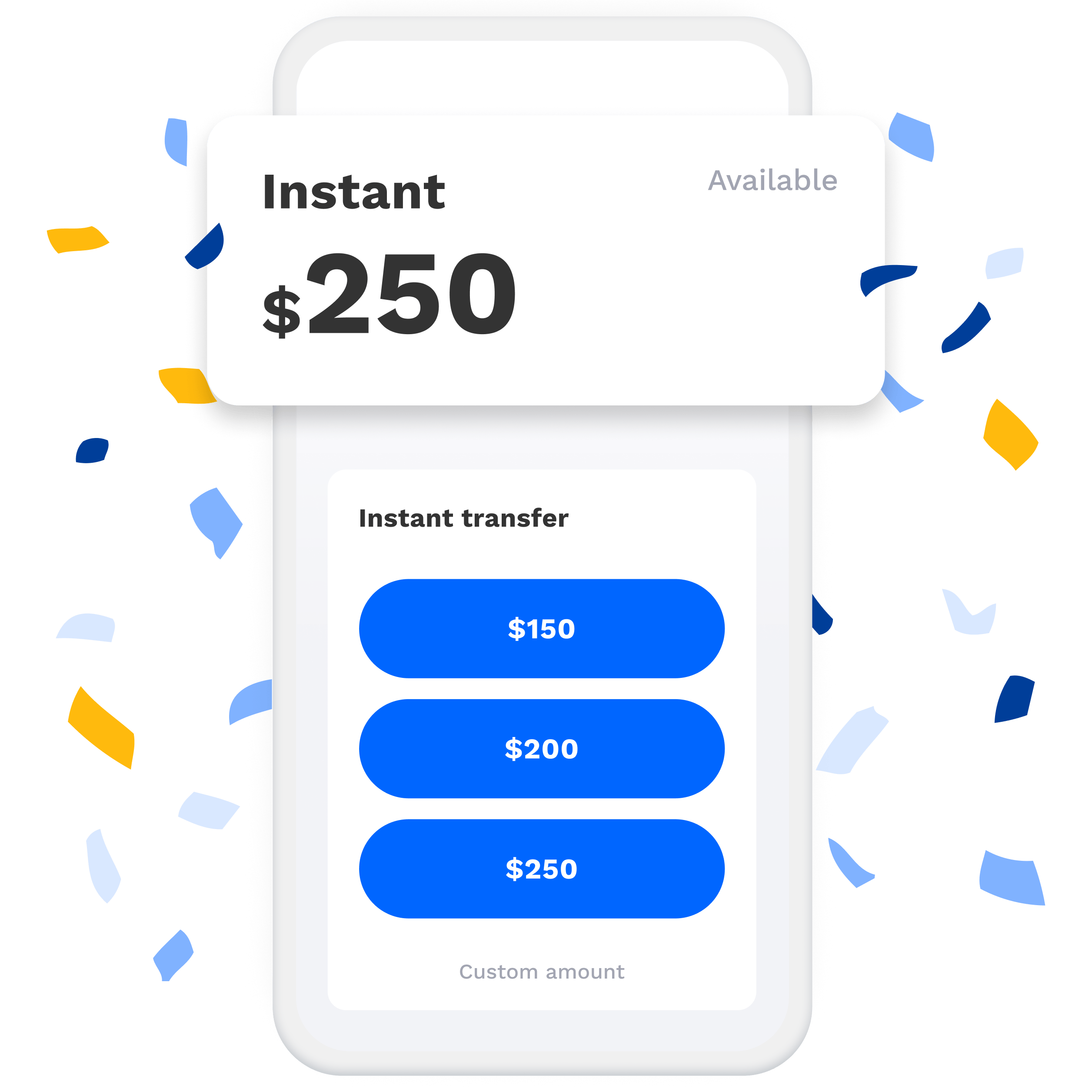

Advance 24/7 offers a couple of main ways to get money: online lines of credit and installment loans. These are different from traditional payday loans, giving you a bit more freedom, you know. With an online line of credit, for instance, you can get approved for an amount, say from $610 up to $4,000, and then you can take out money as you need it, up to that approved limit. It’s a bit like having a flexible money pool you can dip into whenever something comes up, basically.

The Flex Loan is a particular type of line of credit they offer, and it’s pretty unique in how it works. Unlike some other loans where you get a lump sum and pay it all back by your next payday, the Flex Loan lets you apply once and then draw cash out whenever you need it. You don't have to pay everything back all at once, which can be a huge relief for many people, actually. This gives you access to funds whenever they're needed, and you can pay it back at your own pace, which is a pretty flexible arrangement.

Installment loans, on the other hand, are a bit more straightforward. You get a set amount of money, and then you pay it back over time with regular payments. Advance 24/7 offers these too, and they can be a good option if you know exactly how much you need and prefer a clear payment schedule. For example, in Texas, they offer online installment loans, showing they are committed to helping people in that big state, from places like Lubbock all the way to Laredo, you know, when life throws unexpected things their way, like fixing a water heater or dealing with a medical situation.

Related Resources:

Detail Author:

- Name : Kayla Walsh

- Username : hardy.nolan

- Email : nakia.sawayn@damore.biz

- Birthdate : 1986-10-29

- Address : 919 Stroman Courts Tobinville, MD 61373

- Phone : (307) 265-3514

- Company : Senger, Effertz and Pacocha

- Job : Job Printer

- Bio : Et error qui in facere voluptas illo. Possimus odit praesentium voluptatibus consectetur dolores dicta. Beatae accusantium veritatis sed unde.

Socials

instagram:

- url : https://instagram.com/elnora_official

- username : elnora_official

- bio : Debitis aut cumque praesentium fugiat hic nemo. Quia eveniet facilis quo.

- followers : 3307

- following : 2702

linkedin:

- url : https://linkedin.com/in/elnorawest

- username : elnorawest

- bio : Sit eos nihil et veniam quia eos.

- followers : 574

- following : 2105

twitter:

- url : https://twitter.com/ewest

- username : ewest

- bio : Non pariatur repellendus voluptatem necessitatibus eligendi non. Corrupti tempora iure possimus ipsum.

- followers : 2875

- following : 1589

tiktok:

- url : https://tiktok.com/@ewest

- username : ewest

- bio : Exercitationem asperiores et hic eaque. Qui sunt eos est est odio sit pariatur.

- followers : 2071

- following : 1164